Inflation remains stubbornly high, consumer confidence is falling, interest rates are rising and making a motorcycle loan more expensive, so motorcycle sales naturally are... not bad?

While total U.S. new motorcycle sales are not as hot as they were in 2021, they're still higher than 2019, before the pandemic. Dual-sport and off-road motorcycles remain the bright spot in the U.S. motorcycle market. When the pandemic hit and shut down many other activities, lots of people bought dirt bikes, and that trend is still going: People are buying dirt bikes in all their forms, from big adventure-touring bikes to minibikes for the kids to ride in the back yard. But especially street-legal dirt bikes.

"Dual-purpose sales have continuous year-over-year growth since 2016 and impressively, the Q2 2022 sales volume is the highest quarter in the history of the MIC Retail Sales Reporting System for this segment," said Motorcycle Industry Council President and CEO Erik Pritchard. Sales of off-road-only motorcycles cooled off compared to 2020 and 2021, but were still higher than any other year.

In other words, dual-sports and adventure bikes are leading the industry. We've seen anecdotal evidence of that ourselves at RevZilla as attendance was up 62 percent at our second year of Get On! Adventure Fest in South Dakota last month.

Other motorcycle news is mixed

Get beyond the strong sales of motorcycles with knobby tires and the situation is less rosy. Street bike sales aren't much changed from 2019, not having seen the surge that dual-sport and dirt bikes experienced. Harley-Davidson's recent quarterly financial report was an outlier, because the company shut down most production for two weeks due to problems with brake lines provided by its suppliers, and that interruption hurt sales and dealer inventories. Another negative data point came from Polaris' recent quarterly report. Indian retail sales were down a whopping 40 percent in North America in the second quarter of 2022.

Polaris executives blamed that decline not on weak demand for the company's products, but on a lack of dealer inventory as the company is still trying to overcome supply chain disruptions dating back to the pandemic. Current dealer inventory is down 70 percent from what it was in 2019. Based on dealers' experiences in operating with less inventory, the company has revised its estimates of what would be the optimal level of inventory. Still, that optimal level is about 2.5 times current inventory levels, said Polaris CEO Mike Speetzen.

Like other companies, Polaris has seen shipping delays and shipping costs begin to ease and expects that trend to continue in the second half of the year. If inventory recovers and sales don't, then it will become clear Indian has another problem.

There could be other headwinds for the industry in general, too. Rising interest rates make the cost of financing the purchase of a new motorcycle more expensive, but it's hard to see evidence of that affecting borrowing yet. The most recent household debt survey by the Federal Reserve showed a drop in the second quarter in originations of mortgage loans, as the housing market was affected by higher rates, but originations for vehicle loans were still growing.

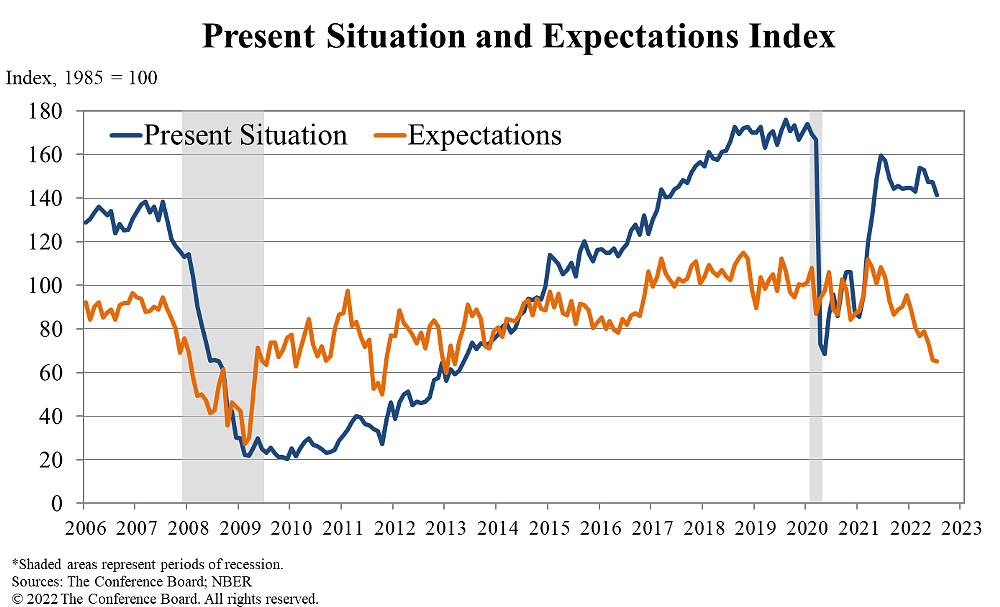

Then there's increasing talk about whether the country is slipping into a recession (or could already be in one). Jobs remain plentiful, but consumer confidence is low and if would-be buyers hesitate because inflation is squeezing their budgets or they fear a recession, that could drag on sales in the second half of the year.

So far, it seems that riders' response to the economic uncertainty has been to get an adventure-touring motorcycle or dirt bike and go for a ride far away from it all. We'll see how strong that trend remains in the rest of the year.