After a nearly 10% drop in estimated U.S. new motorcycle sales in the first half of the year, signs of weakness are showing in the used motorcycle market, which has been a bright spot for dealers in recent times.

The monthly reports from National Powersports Auctions tracks the average wholesale price of the used motorcycles that dealers are buying at auction to stock their showrooms. As such, the report shows whether dealers are eager to obtain more used bikes for sale and are bidding up prices or are pulling back on adding inventory. Average wholesale price typically begins falling in June, once the prime selling season has passed, and begins rising late in the year as dealers stock up for the following spring. But the July report shows not just weakness compared to previous months, but also compared to the same month in 2024.

The July report showed declines in nearly each category compared to the same month last year: Prices were up 1% in domestic cruisers, down 2% in motocross, down 4% in dual-sport, down 6% in metric cruiser, and down 11% in sport. That "sport" category is misleading, because it actually includes the broad range of street bikes, not just sport bikes. So the biggest weakness is in the broadest category. Plus, while the domestic cruiser category may look like a strong spot in the year-over-year statistics, it showed the biggest drop, of 13%, in average prices in July compared to the previous three months. So while it is still a solid category, it was a much hotter category earlier this spring.

In addition to the usual seasonal decline, with many dealers still carrying too much new inventory, which leads to price cuts and manufacturer incentives, pressure on used motorcycle prices is likely to continue and "suggests 2025’s summer slope may be steeper than recent 'normal' years," the NPA report said. And some of those recent years involved much higher post-COVID prices. The NPA report notes that "it looks as if the air has finally been let out of the balloon."

The data on used motorcycle values follows reports showing weaker sales of new motorcycles for the first half of 2025. The Motorcycle Industry Council (MIC) reported that street motorcycle unit sales were down 9.4% for the first half compared to the first six months of 2024. Dual-sport sales were down 11.3%. Off-road unit sales were down just 3.5%, but the much smaller scooter category was down a huge 35.4% year over year.

Unusual sentiment

What's at play here? This is my take. In the U.S. market, almost nobody buys a motorcycle because they need to. It's about want, not need, and that makes it a purchase that can easily be deferred for consumers who are feeling uncertain. And we currently have an unusual anomaly in terms of consumer sentiment.

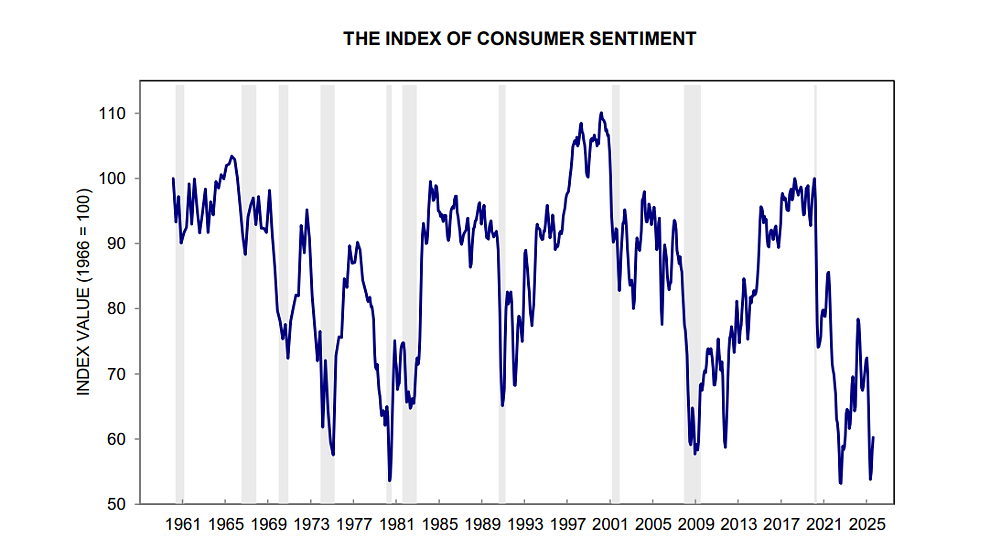

Despite unemployment being low, by historical standards, consumer sentiment as tracked by the University of Michigan Surveys of Consumers is dismal. Sentiment has rebounded somewhat in the last two months since bottoming in April and May, but, as the report for July noted, "While sentiment reached its highest value in five months, it remains a substantial 16% below December 2024 and is well below its historical average." Consider that consumer sentiment now is worse than it was at the bottom of the Great Recession in 2008 and lower than during the 1981-82 recession, when unemployment peaked at a rate more than double what it is today.

The University of Michigan survey asked consumers which purchases they expected to cut back on and the top response was cars, at 19%. It's easy to imagine that motorcyclists are even more likely to put off buying a new ride. Or a used one.

According to the survey findings, among the factors driving that reluctance to spend are inflation, with consumers spending more on basic items, and, despite low unemployment, concerns that the job situation may get worse going forward.

Perhaps consumers would be less dour if they cut back on doom scrolling and did something fun, like maybe ride a motorcycle. But it doesn't seem like that's imminent.