Motorcycle sales have dropped drastically. Pundits are saying the cause has a lot to do with a change in the preferences of the up-and-coming adult generation. The downturn is hitting Harley-Davidson harder than the full-line manufacturers. The president is talking forcefully about unfair trade practices.

Sound familiar?

It may sound like news from today, but I’m actually describing the American landscape 35 years ago. Not all riders know that H-D was on the financial skids in the early 1980s, and of the ones who do, not all understand fully what steps the government took to shield Harley-Davidson and and why. With motorcycles once again being talked about as part of trade disputes, let's look back at the last time around.

A little motorcycle background

World War II brought about domestic rationing of critical materials. Steel, rubber, gasoline, and other items were needed for the war effort. Civilian sales of cars were halted in 1942. Racing was banned. Gasoline was rationed heavily. Motorcycle production shifted to models built for military use.

Most rationing ended in 1945, coinciding with the return of soldiers to America and the country entered an unprecedented period of prosperity after the war. Suppressed demand was unleashed as soldiers came home and began setting up households. The reconstruction of Europe, heavily damaged by the war, also increased demand for U.S. goods, including food.

By the 1960s, however, European motorcycles were once again being produced and imported in numbers significant enough to affect the last remaining American manufacturer, Harley-Davidson. Harley was not really meeting market demand; they’d grown complacent in the era of easy success. Innovations such as liquid cooling, alternative engine layouts, and multiple-camshaft designs were not technologies Harley was investing in. Things also were rocky financially as Harley was still a family-owned company by this point, with few shareholders.

A notable recession occurred in 1960 to 1961. Harley was hurting, and in 1965, the Harley and Davidson family members took the company public, selling shares to raise money. Some of the cash was used to superficially update their product line.

In 1966, a notable stock market crash occurred, weakening Harley-Davidson further. The company faced an attempted hostile takeover by conglomerate Bangor Punta. Peter Henshaw, author of "Harley-Davidson: An Illustrated Guide," quotes Roger Hull, the editor of Road Rider magazine at the time, who spoke later on the topic. “You can’t blame the Harley-Davidson people for getting nervous. Bangor Punta had a reputation for acquiring a company, squeezing it dry, and then scrapping it for the salvage.”

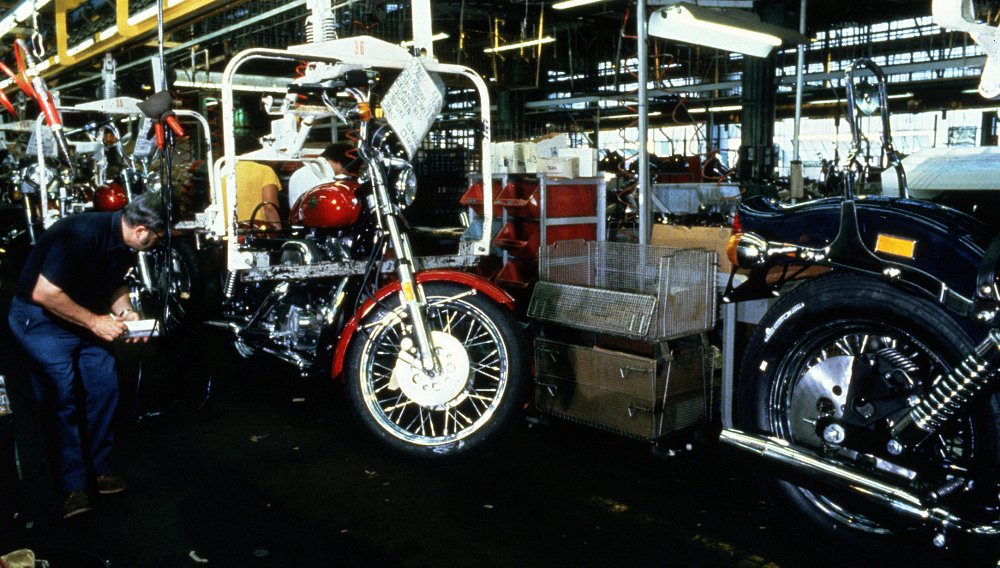

Harley-Davidson instead worked out a friendly buyout by American Machine and Foundry (AMF) in 1969. AMF’s bid was lower than Bangor Punta’s but the deal transpired. The new relationship was a bit of a mixed bag. AMF did many positive things for Harley, but they did fail in a few important areas. Needed tooling purchases were delayed, R&D was an afterthought, and quality control was more or less non-existent. They streamlined production, but in doing so, also severely cut back employment, which did not earn them fans on the production lines.

Quality suffered at perhaps the worst time: 1969 was the year Honda went after the American heavyweight motorcycle market with its blockbuster CB750. Japanese manufacturers had already won 98 percent of the small-bike market with a slew of low-cost, high-quality models, and it didn’t take a financial visionary to guess what might happen now that Japanese manufacturers were producing larger machines.

A little non-motorcycle background, too

Various countries had trade deficits with Japan and concerns grew over Japan’s effectively closed market coupled with its industrial policy in the late 1960s and early 1970s. The U.S. Department of the Treasury began looking into Japanese products that seemed to violate anti-dumping laws. “Dumping” in this context refers to exporting a product at a lower price than is charged in the home market, or selling at a price that is lower than the cost to produce it.

Products suspected of being dumped included textiles, electronics, and raw materials. In 1975, the Treasury investigated the possibility of Japanese cars being dumped in the United States. In 1977, Gilmore Steel asked the Treasury to look into Japanese steel dumping, and in that same year, Harley-Davidson did the same, claiming that Japanese motorcycles were being dumped. Harley’s suspicions were not unfounded. The Japanese were indeed dumping product. Harley rounded up 83 price comparisons for Japanese bikes between American dealers and European ones. Cycle World reported at the time that those differences were as high as 58 percent, representing up to $900 per motorcycle.

In 1978, the Treasury found that “motorcycles from Japan, with the exception of merchandise produced by Suzuki Motor Co., Ltd., are being, or are likely to be, sold at less than fair value.” The United States International Trade Commission, however, found that there was “no injury or likelihood of injury or prevention of establishment of an industry in the United States by reason of sales of motorcycles from Japan at less than fair value within the meaning of the Antidumping Act, 1921, as amended.”

Between 1973 and 1980, Harley’s North American market share of heavyweight motorcycles slid from 75 percent to 25 percent, according to the Organisation for Economic Co-operation and Development.

Tariff applied

A recession brewed in the late 1970s. Unemployment ran to almost 8 percent for much of this time. In an effort to combat inflation, the Federal Reserve raised the federal funds rate. Interest rates hit 20 percent so borrowing money was expensive. Motorcycles, being a luxury good in the United States, were not moving from sales floors. In 1980, H-D posted its first operating loss in half a century — and things were rapidly getting worse. In 1982, a group of 13 Harley employees bought the company back from AMF. However, to do so, they were highly leveraged. To say the company was cash-strapped would be a grave understatement.

Given the huge sales slide they had suffered, the ITC’s “no injury” claim seemed spurious. Harley again requested federal assistance in 1982, this time citing Article XIX of the General Agreement on Tariffs and Trade of 1974, better known as “the escape clause.” Effectively, Article XIX permits a nation to temporarily take emergency action against rapid increases in imports if they’re injuring an industry domestically. This is a nearly universally controversial clause due to the different interpretations of the clause, in part due to confusion over definitions.

President Ronald Reagan ordered a tariff increase under the protection of this clause to be placed upon Japanese motorcycles with a displacement of greater than 700 cc. Tariffs rose from 4.4 percent to 49.4 percent in the first year of implementation. The rate would fall to 39.4 percent in the second year, 24.4 percent in the third year, 19.4 percent in the fourth year, 14.4 percent in the fifth year, and finally return to 4.4 percent.

Results

Due to the huge inventory on-hand, prices of Japanese motorcycles rose slowly. From a practical standpoint, most of the Japanese middleweights, even cruisers, were not seen as direct competitors to Harley-Davidson motorcycles. The New York Times said, “No one disputes that the Japanese companies were dumping bikes. But, motorcycle aficionados note, most of those bikes were so-called 'touring' bikes that appealed to riders who were unlikely to have bought the huge, mean-looking Harleys in the first place.” Touring bikes or not, the question of fungibility is certainly one that could not be answered then and probably cannot be answered now. Furthermore, many Japanese bikes were reworked to squeak in just under the 700 cc limit; such bikes are still referred to informally as “tariff busters.”

Harley-Davidson implemented just-in-time manufacturing, different management strategies, relentless product improvement, and many other ideas stressed by William Edwards Deming. Ironically, many of these theories had been put into (successful) practice in Japan after World War II by companies employing engineers, managers, and scholars trained by Deming. The tariff gave Harley-Davidson a bit of breathing room, which Harley used wisely, by making enormous quality improvements, improving labor relations greatly, and modernizing their business practices.

Harley-Davidson reclaimed its market share and more. In 1987, Vaughn L. Beals, Harley’s chairman and CEO told the U.S. International Trade Commission, ''We're profitable again. We're recapitalized. We're diversified. We don't need any more help.'' He requested the ITC end the tariff plan a year ahead of schedule.

Analysis

Harley-Davidson largely saved their own bacon. Many business studies of the turnaround have been done, and the results are nearly unanimous: their metamorphosis was nothing short of transformational, and through loads of hard work, Harley pulled themselves up by the bootstraps.

However, that’s not to say the tariff was unimportant to Harley’s future. Even if relatively minor in terms of actual economic impact, It was probably a crucial action serving to calm the frayed nerves of Harley’s creditors. The investors who bought Harley back from AMF were very over-extended, and the paucity of excess operational capital was likely causing much temple-rubbing — Even though Harley was visibly righting the ship.

Darwin Holstrom, in "Harley-Davidson: The Complete History," notes that Citicorp, their lender, had continued to lend not out of generosity, but because it was felt that their chances of recovering the loan was better with Harley operational — they didn’t even believe Harley’s carcass would cover the debt. Eventually, even that plan was abandoned, and in November of 1984, Citicorp announced over-advances would stop as of March 1985, which they later pushed to December 31, 1985. Peter C. Reid notes in "Made Well In America: Lessons from Harley-Davidson on Being the Best," “...Citicorp officials began to worry about what would happen when the tariffs on big Japanese bikes ended in 1988.”

Harley CFO Rich Teerlink simultaneously prepared the company for bankruptcy filings and searched for an investor, which only came at the last moment and after much negotiating and pleading. Would their new lenders have materialized without the temporary protection offered by that tariff? Highly unlikely. Harley-Davidson became a publicly traded company in 1986. “Going public was a hard decision, but we had such difficult financial problems it was the only decision,” said Beals.

Was the tariff the correct action for President Reagan to have executed? Can such a complicated topic ever have a “right” answer? That’s certainly a multi-faceted and complex issue, and likely not one I could answer, nor could a consortium of scholars and economists. (They’ve tried, and they have the same problem I do — they leave more questions than answers.)

Even Beals was fairly blunt. “For years, we tried to figure out why the Japanese were beating us so badly. First we thought it was their culture. Then we thought it was automation. Then we thought it was dumping. Finally we realized the problem was us, not them.”

Oddly, among all the politics and money surrounding this issue (and others like it), there is one statement Ronald Reagan made that sums up the issue completely accurately and can in no way be refuted no matter what side of the issue anyone found — or still finds — himself on. “I have determined that import relief in this case is consistent with our national economic interest.” Perhaps that statement cannot be construed as an explanation for enacting the tariff. On the other hand, perhaps it was all the explanation the situation warranted.