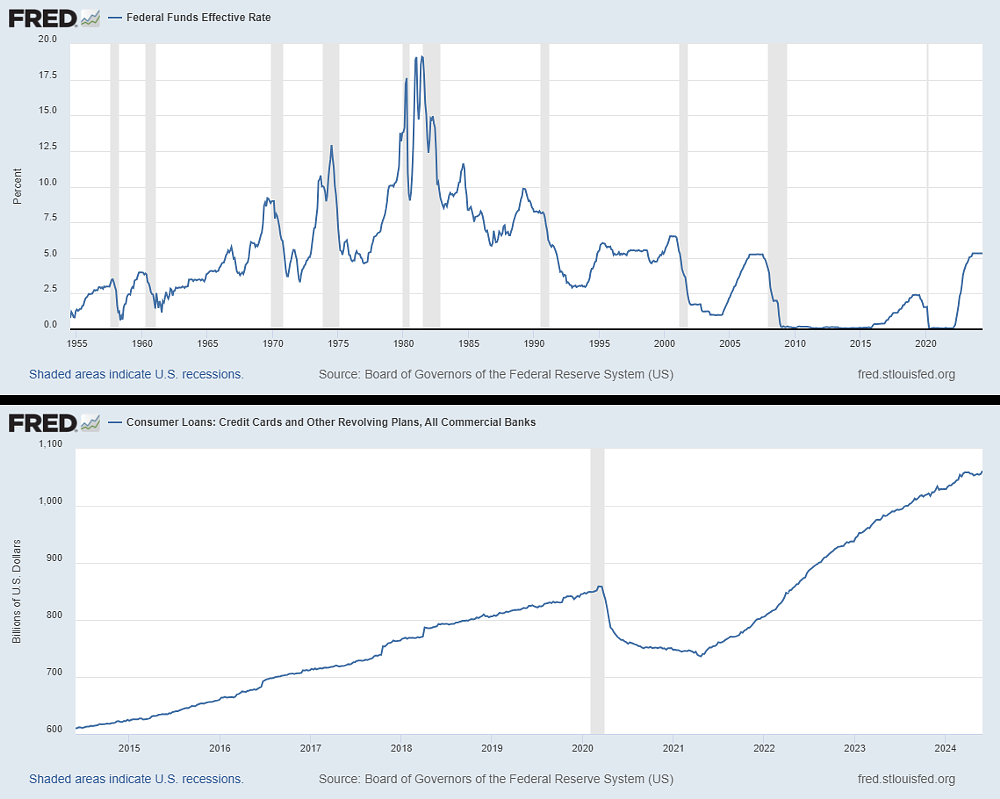

The finance world will be watching the statement from the Federal Reserve today to divine the future of interest rates, but regardless of what comes out this afternoon, it's clear that we are not going to have an immediate return to the unusually low rates of recent years.

Motorcycle manufacturers and dealers know that, and as they have gradually shifted over the past few years from a situation of needing more inventory to the current environment of being fully stocked, offering lower interest rates on loans is becoming an increasingly common form of promotion. Consider it another sign of the evolving times.

Using lower rates to fight the effects of higher rates and inflation

In the wake of the pandemic and related manufacturing shutdowns, dealers' biggest challenge was getting inventory and they were selling everything they could get. Now, they face an entirely different set of challenges. "Increasing costs, adverse interest rate terms, and growing inventory levels top the list of many dealers' concerns," according to a recent monthly NPA Market Report from National Powersports Auctions.

Inflation has squeezed household budgets and higher interest rates — intended to help rein in that inflation — make motorcycles less affordable for buyers who need a loan. As seen in the charts above, consumers have generally used up the savings they amassed in the pandemic and non-mortgage debt has surged back to the long-term trendline, surpassing $1 trillion last year.

One result of this environment is that new motorcycle unit sales were down 5.4% in the first quarter of 2024 compared to 2023 and manufacturers are expecting the full-year results to be soft, as well.

One way manufacturers can counter these forces is to offer consumers financing at lower interest rates as a way to move inventory. Such incentives were non-existent a few years ago, when sales were strong and interest rates were low, but now we're seeing a surge in promotions related to financing.

For example, BMW is offering 0% financing on leftover new 2023 models and many 2024 models. Triumph is offering rates as low as 0.99% on some models and 2.99% on others. Indian is offering 1.99% financing on leftover 2023 models and 4.99% on new 2024s. Ducati is offering loans ranging from 0% for three years to 1.99% for five years on leftover 2023 models. Suzuki is offering rates as low as 1.99% on some models. Yamaha has offered 5.99% interest rates on purchases of new motorcycles using the Yamaha credit card, which may not sound extremely low until you consider that the usual rate for card balances ranges from 15.99% to 23.99%.

LiveWire was counting on its new S2 models, the Del Mar and the Mulholland, to significantly ramp up sales volumes, but we're also seeing promotional interest rates of 1.99% on those new models, which may suggest they're not selling as fast as LiveWire hoped. We'll see when the next quarterly sales report comes out.

We've also seen LiveWire's ancestor, Harley-Davidson, introduce what it calls Flex Financing on certain models, which is a loan that in many ways resembles a lease and takes a different approach to keeping monthly payments lower.

That's not intended to be an exhaustive list of what's currently available, but rather a sampling of enough examples to show the trend. During the pandemic-caused shortages, when inventories were low and so were interest rates, incentives dried up and were replaced by surcharges. Now that inventories are back to normal and interest rates are the highest they've been in a long time, offering a lower rate to help keep buyers' monthly payments manageable is back as a way to move motorcycles.

Of course there are always restrictions. You typically have to have a good credit rating to qualify for the best offers and the term of the loan is usually around three years. So if you're sporting a 500 FICO score and looking to get a five-year loan to stretch out those payments, don't expect to get 2.99%. Also, keep in mind that these offers are usually around for a limited time.

None of this addresses the question of whether these offers are a good idea for you as a consumer. That depends on your personal financial situation. But if you are shopping for a new motorcycle and you're planning to take out a loan to buy it, it could pay to search the manufacturer's website first to see what financing deals are available and press your dealer for details to make sure you're not missing a chance to lower your monthly payment.