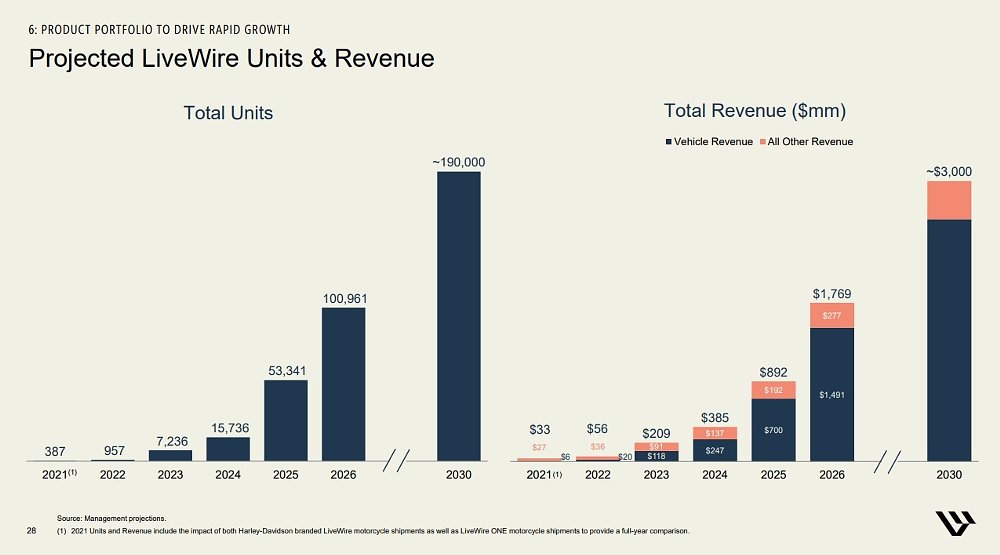

Can Harley-Davidson's LiveWire spin-off go from selling fewer than 400 electric motorcycles this year to selling nearly 101,000 around the world in 2026? That's the plan.

Big news in the electric motorcycle field dropped yesterday, and the headline was that LiveWire, which Harley-Davidson spun off as a separate brand this year, will be the first publicly traded electric motorcycle company in the United States after a deal with a special purpose acquisition company (SPAC) and Taiwan motorcycle and scooter manufacturer Kymco. There's a lot to unpack here, and most of the interesting stuff is buried below that headline, so let's take a closer look.

The deal

In case you're not familiar with the jargon circulating in Wall Street circles in these days of meme stocks and trading mania, a SPAC is also called a blank check company. It's a publicly traded entity that has no operations of its own but pools investor money with the intent of making an acquisition. It provides an alternative way for another company, in this case, LiveWire, to go public, raise funds and begin trading on the stock market without going through its own initial public offering.

In this case, AEA-Bridges Impact Corp. (ABIC) is the SPAC. When the deal is completed next year, LiveWire will be a publicly traded company. Harley-Davidson will own 74 percent of the company, ABIC shareholders will own about 17 percent, ABIC founders will own about four percent and Kymco will own about four percent. For up to two years, Harley-Davidson CEO Jochen Zeitz will be acting CEO of LiveWire and Ryan Morrissey, chief EV officer at H-D, will be the president of LiveWire. For now, LiveWire financial results will be reported along with Harley-Davidson's financial reports.

The goal of the deal is to raise approximately $545 million, which will fund LiveWire's operations and research and development until the company reaches profitability in 2026. That values LiveWire at $1.769 billion, which is the projected revenue in 2026. As one analyst listening to the conference call noted, that's a bigger valuation than most ascribed to LiveWire. Consider that LiveWire expects revenues of just $33 million this year, with only $6 million of that coming from motorcycle sales.

Big plans for growth and new models

LiveWire is counting on rocket-ship growth to earn that valuation in five years. Morrissey said that the expertise and size of Harley-Davidson and Kymco, plus the fact that H-D has a head start on electric motorcycles, will make that possible.

"We believe LiveWire has a four-to-five-year lead over other major motorcycle OEMs, who do not have electric motorcycles on market and have only recently begun development," Morrissey said.

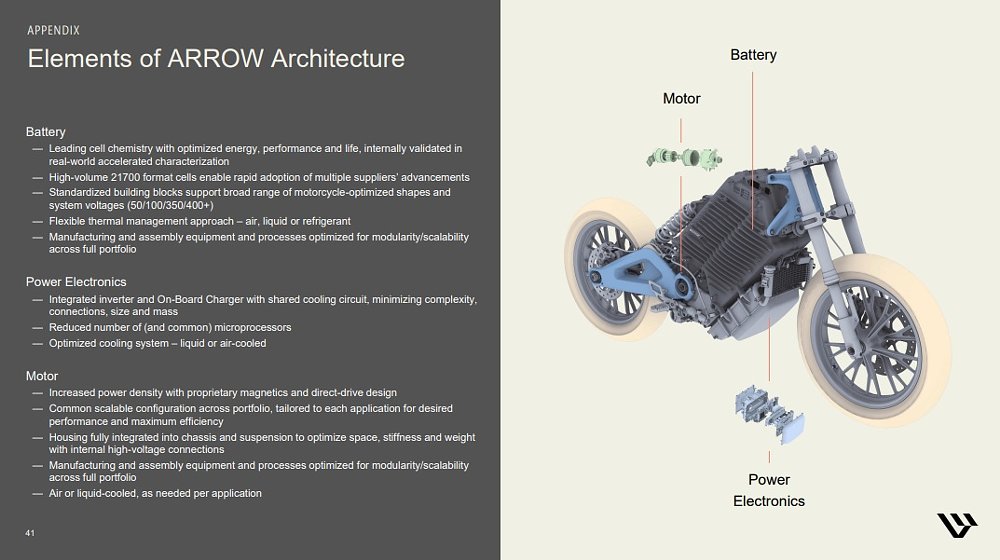

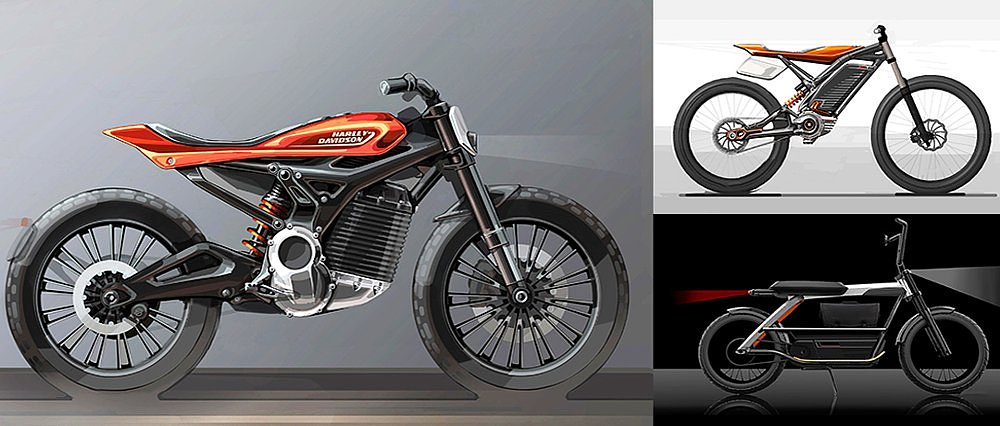

While the only LiveWire vehicle now is the LiveWire ONE — originally the Harley-Davidson LiveWire, selling for about $30,000, but reduced to $21,999 after the spin-off — the company plans to expand with new lines currently labeled S2, for middleweight motorcycles, and S3 for lightweights. The lineup will be built out based on what it calls its ARROW architecture, a modular and scalable system that will make it more affordable to build motorcycles of different sizes.

Morrissey said the initial markets LiveWire will focus on are the United States, Canada, Europe and parts of Asia, specifically Japan, South Korea, China, Australia and New Zealand. He said the involvement of Kymco, with its wide reach in Asia, will be particularly important as the company moves to the lightweight S3 bikes.

Does that mean Kymco will be manufacturing LiveWire motorcycles in Asia? Not initially. The S1 and S2 motorcycles will be manufactured at the Harley-Davidson plant in York, Pennsylvania. Some of the money raised from this deal is to be used to fund expansions at York and another H-D facility in Wisconsin.

What about the longer term? While Harley-Davidson has manufacturing facilities abroad, motorcycles sold in the U.S. market are made domestically, and it would be a symbolic step if LiveWire builds electric motorcycles in Asia and brings them to the United States for sale. That's not in the near-term plans, but when it comes time to build S3 models, I would expect all or most of those to be built in Asia.

Morrissey made it clear the company is talking about motorcycles in this first phase, through 2026. He said the scalability of the ARROW platform means it can be sized up or down and could eventually be used in scooters or four-wheelers such as side-by-sides, but "Over the next five years we're particularly focused on the two-wheel space, so the heavy, the medium and the light motorcycles."

The S2 model listed in the presentation was called the S2 Del Mar. Given the dirt-track connotations of the name, does that mean we'll see a model similar to the street tracker-styled concept Harley-Davidson showed in the past? It's an interesting thought. But with the move from Harley-Davidson branding to LiveWire branding, the dirt-track connection is even more tenuous.

After the S2 and S3 lines, LiveWire will have an S4 line that will presumably be the successor to the LiveWire ONE, with improved tech.

Everyone involved in this deal is counting on rapid growth in electric two-wheelers. The electric motorcycle segment has been the laggard, with both cars and bicycles taking off faster. Harley-Davidson and Kymco certainly have the global reach and now they have a pool of funds. It's up to LiveWire to achieve the aggressive growth projections and go from a few hundred motorcycles to six-figure unit sales and nearly $2 billion in revenue in just five years.

"Incumbents rarely disrupt their own industry," said ABIC Chairman and co-CEO John Garcia. "In autos, it took Tesla to do that. We believe that in LiveWire and Harley-Davidson we have found an incumbent management team with the strategic vision and drive to do that to the motorcycle industry. ABIC will just accelerate that journey.

"We have yet to see what a disruptor who is also a market incumbent can achieve."

LiveWire is not Harley-Davidson

Zeitz is proud to point out that his involvement in getting Harley-Davidson into electric vehicles goes back to the beginning in 2010.

"I started the sustainability initiative and created the push into EV when I was still a board member," Zeitz said. "So this is very close to me."

Not only is LiveWire ONE a very different motorcycle from the Softails and Road Kings that are Harley-Davidson's bread and butter among its core audience, but LiveWire is also a different company trying to send a different message. One of the LiveWire's goals is to meet a target of zero net carbon emissions by 2035. How often do you think a prospective purchaser of a Fat Boy walks into a Harley-Davidson dealership and asks the salesperson about the level of carbon emissions used to create the bike? Yet with LiveWire, it's a consideration.

"Sustainability is not an option for LiveWire," Zeitz said. "It's part of the brand's DNA."

"More than just a motorcycle, LiveWire is the ultimate future-forward brand for the next generation of EV riders," he added. "LiveWire is a change agent."

That raises the question of whether, at the retail level, Harley-Davidson and LiveWire will mix like oil and electrons. To get the electric motorcycles to consumers, Harley-Davidson will naturally take advantage of its huge dealer base, working with dealers who are enthused about the LiveWire line and will set up "store-in-store" facilities. But there will also be separate galleries focused on LiveWire, temporary "pop-up retail" locations and "LiveWire on the road," which will take test ride opportunities to the public.

LiveWire's research shows that riders under age 45 and people who are currently not riders are more likely to choose an electric motorcycle. That's why Zeitz made several references to "the next generation" of riders and why the brand's reach has to extend beyond the big Harley-Davidson dealership network. If LiveWire is successful, it could expand motorcycling just as much as it improves Harley-Davidson's financial results.

More than just a way to make LiveWire a publicly traded company, yesterday's announcement contains a lot to unpack. I have never seen such an ambitious sales growth projection anywhere in the motorcycle industry. Can LiveWire pull it off? The new company has a lot to prove.