LiveWire, the electric motorcycle company spun off by Harley-Davidson, is so far missing its original, extremely ambitious growth goals and has scaled back its estimates for 2023 due to delays in production of its second model, the S2 Del Mar.

Harley-Davidson released its quarterly financial report last week, as well as the full-year 2022 results, and the company overall posted another year of increased profits in the second year of the Hardwire reorganization plan implemented by current CEO Jochen Zeitz. The results were less positive, however, for LiveWire.

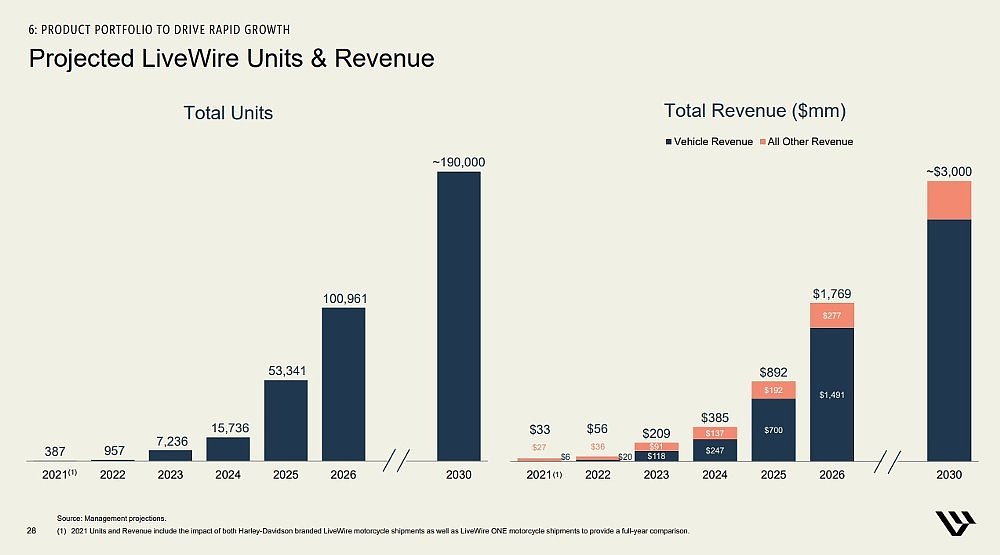

In late 2021, when Harley-Davidson announced it was making LiveWire a standalone, publicly traded company via a merger with a special purpose acquisition company (SPAC), it projected meteoric growth, achieving sales of more than 100,000 units a year in 2026. In last week's report (LiveWire's financial results are still being reported alongside Harley-Davidson's, for now), the company reported that LiveWire fell short of those original projections in 2022 and will fall further behind in 2023. The company originally planned to begin delivering its second model, the less expensive S2 Del Mar, in the spring of this year. Now, those motorcycles won't be ready for sale until the second half of the year, meaning LiveWire will not have Del Mars available during the busiest selling season.

What does that mean in numbers?

In the 2021 projections, LiveWire expected to sell 957 motorcycles in 2022 and actually sold 597 at wholesale. Revenue also came in short of the original 2021 projections, at $47 million versus $56 million, and the 2022 operating loss was $85.3 million. The 2021 projections called for 7,236 motorcycles to be sold in 2023, mostly Del Mar models, and now those estimates have been scaled back dramatically to a wide range of 750 to 2,000 motorcycles.

In the conference call following the release of the quarterly financial results, LiveWire President Ryan Morrissey confirmed, in response to questions from financial analysts, that the delay in Del Mar production was the cause for the big rollback in expected 2023 sales.

"Given the new timeline, we're now expecting sales to ramp up in the second half of the year for that motorcycle," Morrissey said. "So, we brought the units down accordingly, taking the industry seasonality into account. So the bike continues to look amazing. We're laser-focused on getting it to market, but the change in the timeline is what's driving that change in the units."

Personally, when I saw those growth estimates in December of 2021 I was surprised by how aggressive they were. Has any vehicle manufacturer in history ever gone from under 500 vehicles sold in the first year to more than 100,000 five years later? I asked LiveWire whether those 2021 projections are still considered viable but company management declined to comment beyond the statements made in the conference call. On that call, Morrissey did not specifically refer to the earlier projections but, in response to a question, he said, "we think if you continue to look at the long-term trajectory and the long-term goals that we've set for the company, they continue to be the right ones."

There were some pieces of positive news for LiveWire. The company will begin selling electric motorcycles in Europe in 2023 in France, the UK, Germany, the Netherlands, and Switzerland. Sales of the Stacyc electric balance bikes for kids are growing, Morrissey said, providing "double-digit year-over-year revenue growth" as new products are added to expand the line.

In the conference call, Morrissey actually characterized the 597 LiveWire ONEs sold in 2022 as beating expectations of 500 units. But as the chart above shows, that was not the original projection that was given to potential investors in LiveWire stock before the company went public. And as late as the end of September, when LiveWire went public, Zeitz reiterated the goal of selling more than 100,000 units in 2026. LiveWire is going to have to ramp up sales dramatically to meet those goals.