You come to Common Tread for motorcycle news. Then there's all this:

KTM has a reorganization plan. No, wait, they need more time to find the money. Production of motorcycles resumes. Production of motorcycles stops again.

Harley-Davidson's CEO is retiring. An investor mounts a battle over the board of directors. Harley-Davidson is considering selling its financial services division. No it isn't. What about tariffs?

The motorcycle news often looks a lot like the business news lately. Should you care about any of this? Or, to flip the question around, should Common Tread be covering all this or should we stick to writing about the 0.5% horsepower boost and new ride modes on the latest $30,000 European wonderbike?

Legitimate questions.

Some are easy to answer. If you own or aspire to own a KTM or Harley-Davidson motorcycle, then for perhaps symbolic reasons as well as practical ones — such as which models will be available for you to buy, future parts availability, and resale value — yes, you probably should care. If you have no interest in owning a KTM or Harley-Davidson, then you might decide you can scroll on, though there's a legitimate argument that the industry as a whole, and the options we have as consumers, are affected by the turmoil at big players such as the largest European motorcycle manufacturer and the largest U.S. motorcycle manufacturer.

Some motorcycle web sites choose to stick to writing about new models and gear, avoiding "politics" — and, apparently, economics — in their coverage. Others have taken to writing weekly (or more frequent) rants about what's going on at KTM and Harley-Davidson.

When people tell me — especially young people, with many years ahead — they can't stand politics and therefore ignore it, I reply — no doubt annoyingly — that you can choose to ignore politics, but politics won't ignore you. At the same time, here at Common Tread we recognize that people come here for our content mostly because motorcycles are a source of joy in their lives, and inserting the news of the wider world's conflicts or the manufactured outrage that some sites and influencers peddle is probably not adding joy to your experience.

So we try to strike a balance.

With that overly long preamble done and that balance in mind, let's take a quick look at recent developments.

KTM floundering

KTM and Harley-Davidson are lumped together in this article because both are in the news, not because their situations are the same. Harley-Davidson has its share of conflict at the moment and faces some challenges, but it's still a profitable company. KTM's very existence is in doubt.

KTM has until May 23 to raise the €600 million to eliminate its debt by paying off 30%, as approved as part of its restructuring plan. The expectation was that the infusion of new investment would have been completed by now, but talks are still ongoing.

Parent company PIERER Mobility AG received a waiver to file its 2024 annual report late, but recently reported unaudited preliminary numbers. As the various subsidiaries work to reduce the excess inventory of unsold motorcycles, total company revenue was estimated at €1.879 billion, a 29.4% decrease from 2023, leading to a pre-tax loss of €1.28 billion. The preliminary figures also noted that the employee headcount dropped from 6,184 at the end of 2023 to 5,310 at the end of 2024.

The main question is whether KTM's partner, Bajaj Auto of India — or potentially some other investor — is going to come through with the money needed for the restructuring plans and under what terms. I'm not even going to try to speculate what's going on behind closed doors in negotiations, but the fact that KTM is going down to the wire to secure the funding does not inspire confidence.

One way or another, this story is going to take another crucial step in the coming days.

Harley-Davidson infighting

If KTM is floundering, at Harley-Davidson they're fighting. We've already reported that the company is looking for a successor to controversial board chairman, president and CEO Jochen Zeitz. Shortly after that announcement, news came out that one board member resigned and the investment company he represented, H Partners, which owns about 9.1% of Harley-Davidson, was trying to oust Zeitz and two other board members by mounting a proxy battle in the board of directors election this month.

Returning to the central question of whether you should care about an internal battle on the board, for most of us the answer is "Probably not." In a nutshell, H Partners is unhappy with the performance of its big holdings of Harley-Davidson stock and blames Zeitz and two board members it says are not really independent. Harley-Davidson fired back, noting that the resigned board member never voted against any of the initiatives that H Partners is now criticizing and suggesting that H Partners is just unhappy because its choice for the new CEO was not hired by the board. The two sides have set up competing web sites, so if you really care, get the full arguments at freetheeagle.com and voteharleydavidson.com. H Partners was later joined by another large shareholder, Purple Chip Capital.

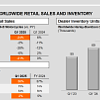

Against this backdrop of internal conflict, Harley-Davidson announced its first-quarter financial results last week. The company continues to throttle back shipments to dealers to keep drawing down the excess inventory on dealership floors. Global retail sales of motorcycles were down 21% compared to the same quarter last year and profits were down 38%. Harley-Davidson projects the new tariffs being imposed around the world will cost the company between $130 million and $175 million this year. Like many other companies, it withdrew its financial guidance for 2025, largely because of the uncertainty of where those tariffs will finally settle.

Another interesting news nugget is that Harley-Davidson is edging ever closer to giving up on LiveWire. The electric motorcycle spinoff originally projected sales of more than 50,000 units this year, but sold just 33 motorcycles in the first three months of 2025. Sales of STACYC balance bikes for children, LiveWire's other product, were also down 33% from last year. CFO Jonathan Root said Harley-Davidson will provide no more money to LiveWire beyond the current $100 million line of credit.

The other news: New, less expensive models from Harley-Davidson

Finally, if you've read this far, you deserve at least one news nugget that undeniably doesn't have anything to do with political policies, trade wars, or economic realities. Over the past year, Harley-Davidson has hinted at forthcoming entry-level motorcycles, one of the things its opponents in the board of directors fight are asking for. Harley-Davidson has tried to address its lack of an affordable entry into the brand by lowering the price of its Nightster from $11,999 in 2024 to $10,499 this year and then lowered it again, more recently, to $9,999 to match the Indian Scout Sixty Bobber, the least expensive U.S. competition. But the Nightster and Sportster models aren't selling well.

While details are still scarce, Zeitz did confirm in last week's conference call that less expensive models are coming, saying we can expect to see "new entry-level products in smaller displacements as well as the introduction of an iconic classic for the U.S. and international markets starting next year. We expect these products to be highly affordable and profitable additions to our portfolio."

Now that Harley-Davidson has invested in its core products, its touring bikes and big baggers where it makes the vast majority of its money, it can turn to entry-level models, Zeitz said. But he's not about to abandon his focus on profitability.

"Historically, if I look at the last 30 years, we've never had an entry model that actually made money for Harley-Davidson," Zeitz said in response to question from an analyst. "And we believe that we have an opportunity now, based on how we're engineering these bikes, to actually come out with a product that is competitive, that is in look, sound, and feel very Harley-Davidson, and profitable."

What does that mean we can expect to see? Harley-Davidson's previous effort, the Street 500 and 750, missed the mark on both appearance and riding experience. The current Nightster and Sportster models perform well enough but don't appeal, looks-wise, to most buyers. Presumably, Harley-Davidson has learned lessons from those disappointments.

Could the "iconic classic" be some updated version of the Evo Sportster 883? I wouldn't be surprised.

More interesting to me is the issue of profitability. Now that Harley-Davidson has crossed the previously uncrossed line and is manufacturing motorcycles in Thailand that are for U.S. sale, not just international sale, does that mean the new entry-level line will be assembled abroad to keep costs down? Will tariffs upend that plan?

Zeitz and company are staying tight-lipped, and anyway, a new CEO will presumably be in charge before the year is out. The unknowns still far outnumber the knowns at Harley-Davidson, just as they do at KTM.