Two of the favorite Common Tread reader pastimes are questioning Harley-Davidson's corporate strategy and pointing out reasons why electric motorcycles will never catch on. Any time I write an article that touches on either of those topics, the reader comments flow in like the beer in Aspen.

While our readers cover the full range of opinions, the most prominent and common skeptics seem to stake out these positions: Harley-Davidson's strategy of abandoning affordable motorcycles and focusing on selling high-priced, high-margin touring models means the company is eventually doomed, once Baby Boomers age out of riding and younger riders haven't been welcomed into the Harley-Davidson clan. And range issues and price tags mean electric motorcycles are destined to remain niche products, never being widely adopted.

The most recent news out of Milwaukee is mixed. It supports one of those skeptical theses and contradicts the other. Here are two things we learned from Harley-Davidson's earnings report at midyear.

The Harley strategy is working, at least for now

Ever since Jochen Zeitz took over from Matt Levatich as Harley-Davidson CEO, the company has done a rapid, 180-degree turn in strategy. Or at least as rapid as a ship this size can turn. The former "More roads to Harley-Davidson" strategy, which focused on introducing new models and attracting new customers to the brand, has been replaced under Zeitz by a focus on selling fewer, more expensive motorcycles with bigger profit margins. That's why, today, the least expensive new Harley-Davidson you can buy costs around $12,000 but the real focus is on the company's Grand American Touring segment, where prices start at about $25,000.

Naysayers predict that Harley-Davidson is doomed because Boomers will soon stop buying motorcycles, not enough younger buyers will have been drawn into the orange-and-black fold, and H-D sales will nosedive. It's a plausible-sounding argument. Here's the thing, though. By any objective measure, it hasn't happened (at least not yet).

In its latest quarterly results, Harley-Davidson reported that while North America retail motorcycle sales were down 1%, sales of the expensive Touring and CVO models were up 12% in the United States. That contributed to a 12% increase in overall revenue and a 20% increase in revenue from motorcycles. This fits a pattern we've seen in recent quarters. Whether you like the strategy or not, Harley-Davidson truly is executing on its plan to make more money by selling more expensive motorcycles, not by selling more motorcycles.

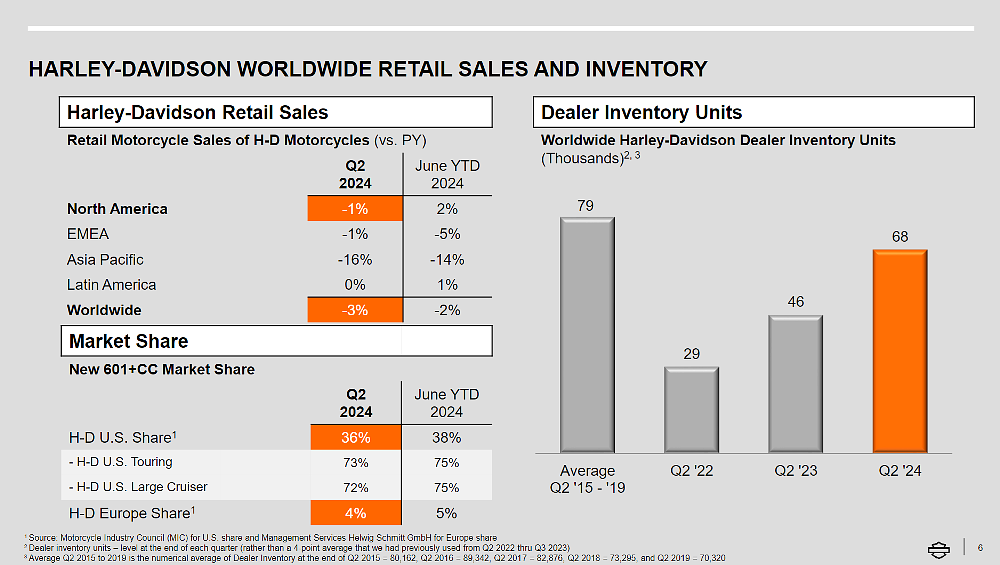

Now diehard skeptics could still hang on to two factors. First, while retail motorcycle sales were flat to slightly lower in every region of the world, Harley-Davidson's shipments to dealers were 16% higher in the second quarter of 2024 compared to the same period in 2023. As you can see in the chart below, that's part of a process of rebuilding dealer inventory levels to where they used to be, pre-pandemic. Skeptics might argue that Harley-Davidson shipping more motorcycles to dealers than they are selling is providing only a temporary bump in revenues, not a lasting one.

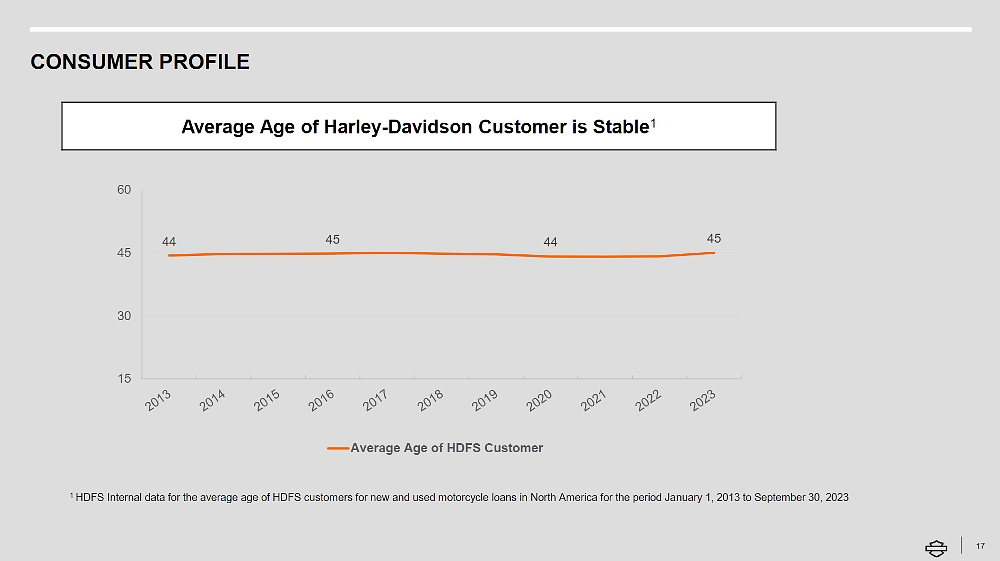

Second, skeptics can argue that their theory isn't wrong. It's just that the day of reckoning hasn't arrived, yet, and eventually Harley-Davidson will start suffering for not having brought new customers into the brand. I get the feeling Harley-Davidson executives are tired of hearing this, because they also included a slide in their presentation that directly refuted the notion that their customers keep getting older and older. The chart below shows the average age of customers applying for motorcycle financing through Harley-Davidson Financial Services over the past decade. No signs of aging in that (non-) curve.

Maybe, just maybe, Harley-Davidson's brand appeal will remain strong enough that young riders who can't afford a new Harley-Davidson will still want one as they move up the income ladder, they'll buy that $25,000 Road King Special as their first Harley, and the company will continue turning in solid quarterly profits despite never growing unit sales. Whether you believe in that or not, that's the way it has gone so far.

LiveWire still low voltage

Electric motorcycle skeptics, on the other hand, got some confirmation from the quarterly report. Harley-Davidson put the best spin on things, noting that LiveWire is currently the top seller of on-road electric motorcycles in the United States and sales were up 186% in the first half of 2024 compared to the first half of 2023. That sounds less impressive in raw numbers, however. LiveWire sold 275 motorcycles in the first half of the year. Unit sales were expected to increase as the first two S2 models, the Del Mar and the Mulholland, which cost about two thirds the price of the flagship LiveWire ONE, hit the market.

LiveWire is still projecting sales of 1,000 to 1,500 units this year. That would mean the company has to sell three times as many motorcycles in the second half as it did in the first half. And the current projections pale in comparison to the sales goals LiveWire released before the company went public. Nobody mentions those estimates any more, because back then LiveWire projected sales of more than 15,000 motorcycles in 2024.

In other LiveWire news, the company has been approved to receive $89 million as part of a $15.5 billion U.S. Department of Energy program offering grants and loans to support the domestic electric vehicle industry. In LiveWire's case, the money is intended to be used to expand and convert manufacturing space in Harley-Davidson's big assembly factory in York, Pennsylvania, to retrain employees, and to add more than 125 workers. Which raises some questions. Can LiveWire sell enough motorcycles over the next decade to make an investment of 89 million taxpayer dollars look like a good idea? If it expands production, can it sell the greater production?

Like the success of Harley-Davidson's strategy, there are hints in the present but the firm answers won't arrive for years to come.