You don't have to be a die-hard Harley-Davidson fan to have noticed that multiple H-D dealers have closed their doors or consolidated multi-store operations in recent years, even some that have been around for a century.

Examples are nationwide, from San Francisco Harley-Davidson, originally founded by AMA Hall of Famer Dudley Perkins, closing after 110 years, to New York Harley-Davidson shutting down. And it's not just dealerships in high-cost urban areas. Dealers have closed in Illinois, Ohio, Wisconsin, Minnesota, Colorado, Wyoming, Florida, and elsewhere.

This wave of closures has been variously attributed to the graying of the motorcycling population, or the lack of new riders coming into the sport, or Harley's own strategic direction during the tenure of controversial CEO Jochen Zeitz. George Gatto, a second-generation Harley dealer and chairman of the National Powersport Dealers Association's (NPDA) Harley-Davidson Dealer Council, has a much simpler explanation for why so many dealerships, even long-established ones, are going dark: "They're not making any money."

Gatto admits that's an oversimplification, citing a number of factors that contributed to the demise of so many dealers. The catalyst was the COVID-19 pandemic, the worst of times for the world but profitable times for Harley-Davidson dealers.

"As anyone in the recreational business knows, we couldn't get enough product during COVID," Gatto says. "The manufacturers were all ramping up production trying to meet that demand. Those were the most profitable years we've ever experienced in my entire career. There wasn't enough product, so there was no negotiation. Everything sold at full price."

The post-COVID years, Gatto says, "especially once the interest rates went up, was when all hell broke loose and sales fell off a cliff. There was too much inventory and manufacturers were pushing dealers to take it. I think all the manufacturers thought the boom would continue longer than it did."

Higher interest rates hurt dealers not just because they made a loan for a new motorcycle more expensive for consumers, but also because they significantly increased dealers' costs. Dealers pay interest on units in stock that aren't sold yet, called "floor plan" in the business. Due to the lethal combination of high interest rates and excess inventory, some dealers were paying more than $25,000 and even as much as $40,000 a month in interest, Gatto said. Dealer profit margins plummeted.

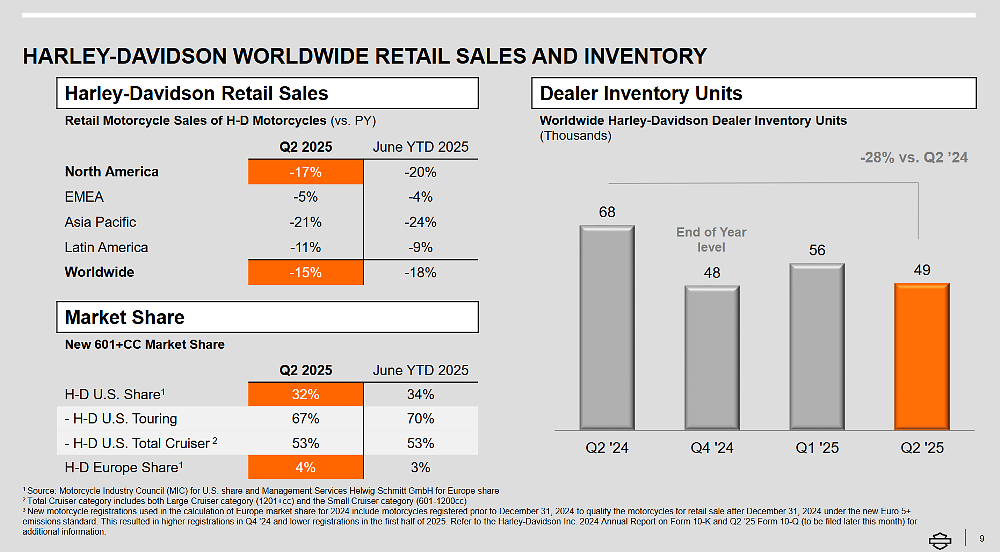

One possible perspective is that there are simply too many dealers. In its peak year, 2006, about 344,000 Harley-Davidson motorcycles were sold at retail locations around the world. That number has steadily fallen ever since to just over 151,000 in 2024.

"I'm a dealer, and I hate to admit this, but there are too many dealers for the number of new vehicles that are being sold today," Gatto says. "Margins on the new bikes are the worst we've ever seen."

Fewer motorcycle sales per dealer is an obvious headwind, but dealers faced other pressures, too.

During the boom years, Harley-Davidson decided it was a good time for dealers to upgrade their facilities, beginning with the dealers who hadn't remodeled in the longest time. Gatto says, "They came up with 187 pages of rules" for remodeling and the price tag varied by dealer.

"In my case, it was almost $7 million just to remodel the buildings," Gatto says. "They wanted me to tear out a second floor, put an addition on, and remove the drop ceilings, so I would have to redo all my plumbing, my ductwork, my electrical. They wanted me to basically gut the building and redo it. It would have bankrupted me." Gatto worked with Harley-Davidson and got the final price tag down to about $400,000. Today the 187 pages of rules is down to about 10 pages.

Gatto says that one of the longest nails in some dealers' coffins was H-D's move into e-commerce. The post-COVID inventory glut included not only bikes, parts, and accessories, but also clothing — jackets, boots, gloves, and helmets. "They overproduced, so what do they do?" Gatto says. "They mark it down 40%, 50%, 60% online, with free shipping. Why would you go into a dealership when you're getting half off online?"

The less quantifiable problem with H-D's push into e-commerce was reduced foot traffic in dealerships. "Consumers were trained to buy Harley clothing and Harley parts online instead of going into a dealership. You know how it is when you go into a dealership and you see that shiny chrome or blacked-out bike and you're like, 'Wow, that's beautiful. I want it.' Well, those people weren't coming into the store anymore."

Given all these pressures, it's not surprising many dealers are deciding to close up shop.

"When I have a really great month, and I look at where all my sales came from, a lot of those sales came from my local competitors. A lot of these guys are good friends of mine. I'm cannibalizing sales off my dealer friends and they're cannibalizing sales off of me based on price because there's too much inventory," Gatto says.

For the record, we contacted Harley-Davidson management for their perspective on these issues. Specifically, we asked for management's explanation for the number of dealers closing. We also gave them a chance to respond to Gatto's assertions about the costs of required remodeling of dealerships and the effect of the corporation selling parts, accessories, and clothing online directly to consumers, bypassing dealers. Harley-Davidson management declined to comment.

It's also fair to note that Harley-Davidson has recognized the issue of dealers having too much inventory and has cut back production and taken other measures to reduce the number of motorcycles on dealership floors. In its most recent financial report, the company said it had reduced worldwide dealer inventory from 68,000 units a year ago to 49,000 units at the end of the second quarter of 2025.

One of the reasons Gatto and other dealers formed the NPDA was to try to gain a little more clout with the manufacturers. Gatto blames many of the dealers' problems on Zeitz and says the Zeitz years are a break from what has historically been a good relationship between Harley-Davidson and its dealers. On October 1, a new CEO will take over. Gatto said he and some of the other dealers he's talked to are optimistic that the change in leadership will be good for Harley-Davidson dealers, and could stop the trend of dealerships closing.