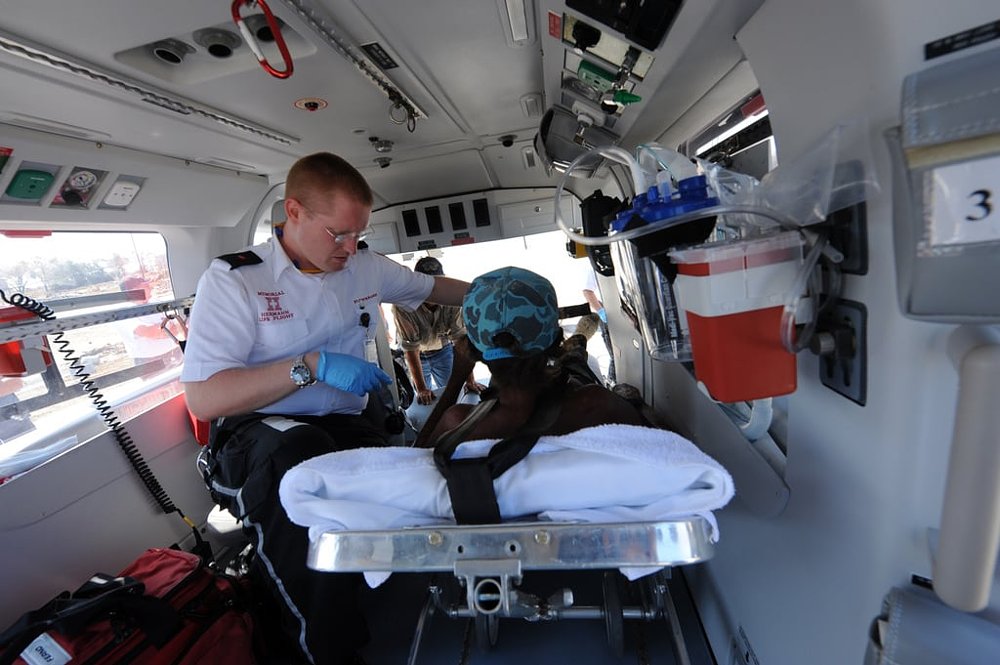

It’s the helicopter ride no one wants to take. An air ambulance ride after a motorcycle accident is a worst-case scenario, not only because the injuries suffered are probably dire, but also because the financial consequences can be life-altering.

An air ambulance ride — often referred to colloquially as a life flight, which is also a name some of the private companies use for the service — can cost an astronomical sum, and that cost can be passed on directly to the patient. The New York Times reported that motorcyclist Diana Kidd received an invoice for $36,646 after being life flighted after her accident, a bill her health insurance claimed didn’t fall under her policy. In an extreme case, National Public Radio shared the story of how Sean Deines was billed $489,000 for an air ambulance ride in 2020.

How can an air ambulance trip possibly cost that much? It’s well known that medical care can be expensive, and adding a helicopter on top of that only exacerbates the problem. According to Air Methods, one of the companies that provides the service, to operate one air ambulance helicopter requires a staff of 13 — four pilots, four nurses, four paramedics, and a mechanic — in order to maintain around-the-clock readiness to deploy at any time. That is a lot of costly upkeep for aircraft and highly trained personnel, but the calculus doesn’t entirely explain the exorbitant prices.

Life flight pricing demystified

In a report from 2017, the U.S. Government Accountability Office (GAO) surveyed key stakeholders in the air ambulance industry to better understand the pricing structure. What it discovered was an industry that dodged regulation thanks to the Airline Deregulation Act of 1978 (ADA), a shift from hospital-affiliated providers to private for-profit companies, an over-saturation of air ambulances with too few flights to cover the costs, and a standard business practice of jacking up rates for patients with employer-provided health insurance.

For instance, according to Medicare data in the report, the median price paid for air ambulance service by Medicare was only $6,502. Meanwhile, private health insurance companies would be charged between $15,600 to $26,600 for the same service. The GAO report states that “Representatives of the providers we spoke to said that privately insured patients account for the highest percentage of their revenue. For example, seven of the eight providers indicated that the majority of their transport revenue comes from privately insured patients, which accounted for a minority (22 to 41 percent) of their overall transports in 2016.”

When air ambulance companies don’t get their invoices satisfied by private health insurance companies, they turn to the patient for balance billing. Many patients negotiate down the original rate, or apply pressure to their health insurance companies to cover the entire bill. For those unwilling or unable to pay, the providers are not afraid to play hardball to get their money. In the case of Patricia Dotson, she had to resort to filing for bankruptcy when Air Methods put a lien on her house when she couldn’t pay the $22,150 bill.

Insurance options

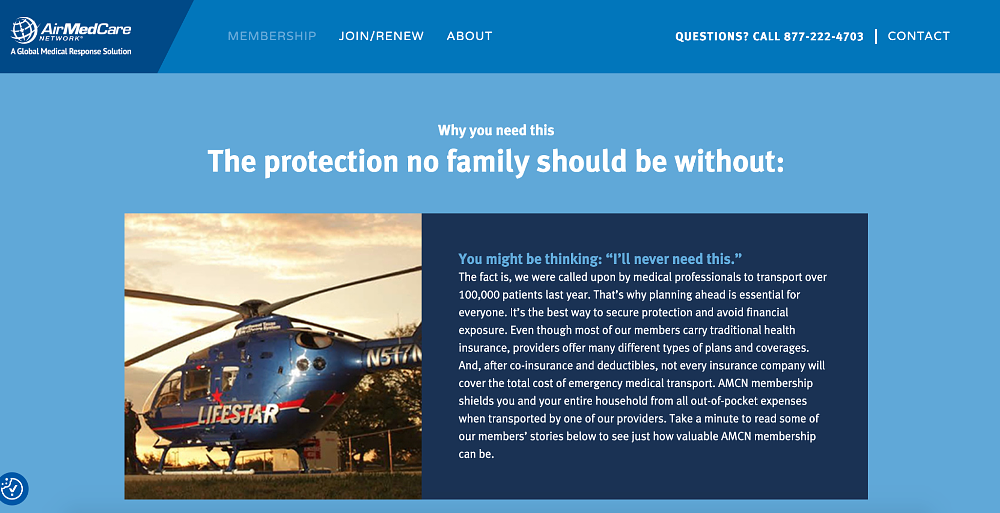

It’s stories like these that prompted myself and many riders to opt in for extra insurance to cover air ambulance service. For as little as $79 per year, a membership with a local provider covers any emergency medical air transport for my entire household. Considering I live in a rural community and often ride motorcycles in remote areas, it seemed like the prudent thing to do.

I enjoyed good peace of mind on this decision until I had a rude awakening. I witnessed a medical helicopter transporting a rider after an accident at my local track day, and I realized it was a different provider from the one I have a membership with. After some light research, I discovered there are no guarantees I would be picked up by my chosen air ambulance provider and in Southern California there are at least four other competing providers that could potentially pick me up. If any other air ambulance transported me, I would be exposed to the financial risk I was trying to protect myself from.

The No Surprises Act

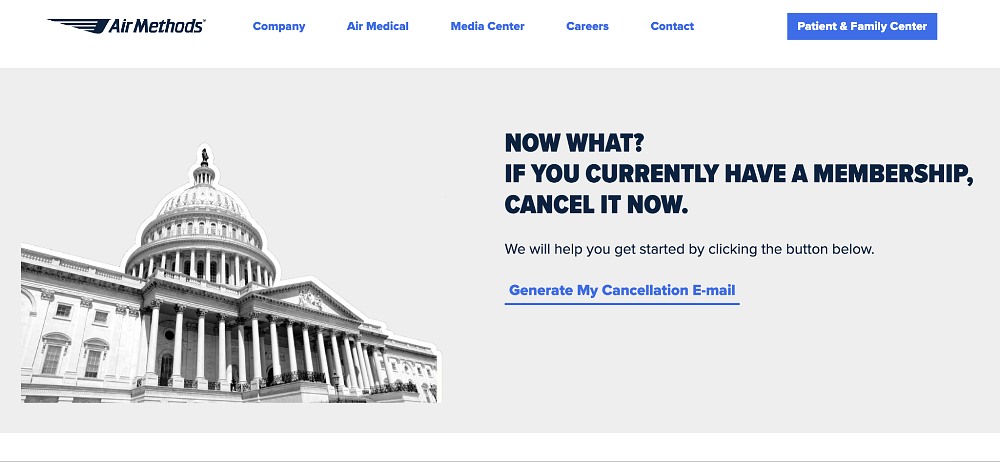

Thanks to the No Surprises Act (NSA), a federal law that went into effect in January of 2022, there is some good news: Air ambulances are prohibited from issuing balance billing to end patients. The NSA has already affected the air ambulance industry, with prices being adjusted and more companies opting to become in-network providers with health insurance companies.

It is a step in the right direction, but riders are not completely out of the woods. As it is with every aspect of medical coverage in America, your health insurance provider can still contest whether your flight was “medically necessary” and then, instead of fighting over billing with the air ambulance company, you get to duke it out with your policy provider. There is also, of course, all the usual co-payments, co-insurance, and deductibles that you would need to worry about for any medical emergency.

And as you can see in the graphics below, different companies have different opinions on whether the NSA means you don't need additional coverage.

Best practices for motorcyclists and air ambulance insurance

If you are unsure about what your risk level is when it comes to air ambulances, or what you can do to protect yourself from huge life flight bills, check out the guidelines below to get some direction.

-

Review your riding style and locations

Evaluate your risk based on the riding you do. A club racer who competes at a rural track or an off-road rider who likes to explore remote areas is more likely to need air ambulance services than a rider who sticks to paved roads. If most of your riding occurs within a 30- minute radius of population centers and hospitals, odds are that you are less likely to need an air ambulance in case of an emergency. -

Carefully review your health insurance policy

Especially the parts regarding medical emergencies, hospital visits and transport. Read it, understand it, and follow up with your healthcare provider with any questions you have. Have them confirm, in writing ideally, to what extent your policy will cover you in case of an air ambulance emergency. If the language they use is overly vague, or they outright refuse to cover medical flights, looking for a supplemental insurance policy is probably a good idea. -

Consider if a medical flight insurance membership makes sense for your situation

Even with the NSA shielding you from balance billing, an air ambulance insurance policy may still make sense, depending on your living situation. Do you live in a remote community where flights for other medical emergencies beyond riding might occur? Do you have family members who can also benefit from the yearly membership? Do you live in an area with only one provider, so you can have confidence they will be dispatched to your emergency? Are you worried about the impact of copayments and deductibles on your regular health insurance policy? If you answer “yes” to the majority of these questions, a life flight insurance policy may pay off. Explore what’s available in your region, how much it costs, and weigh if it makes sense for you. -

Consider services from emergency satellite communicators or travel insurance policies

Many riders already travel with devices like Garmin Inreach or SPOT. While at a base level the function of these devices is to communicate to dispatchers that an emergency requires a response, there are other memberships riders can opt in to that offer more coverage for specific medical evacuation situations. Similarly, there are dedicated travel insurance companies that offer global coverage for med-evac. These are far pricier than the local life flight plans, but if you travel to far away lands to ride bikes, it may be a worthy investment.

An air ambulance ride is a worst-case scenario, but getting ahead of the potential fall out that happens afterward can ease the burden on you and your loved ones. Get familiar and assess your individual risk level, and plan accordingly.