Last Friday, President Trump expanded the breadth of his existing aluminum and steel tariffs to include additional “derivative” products. The list contained 407 new product categories, including (you guessed it) motorcycles.

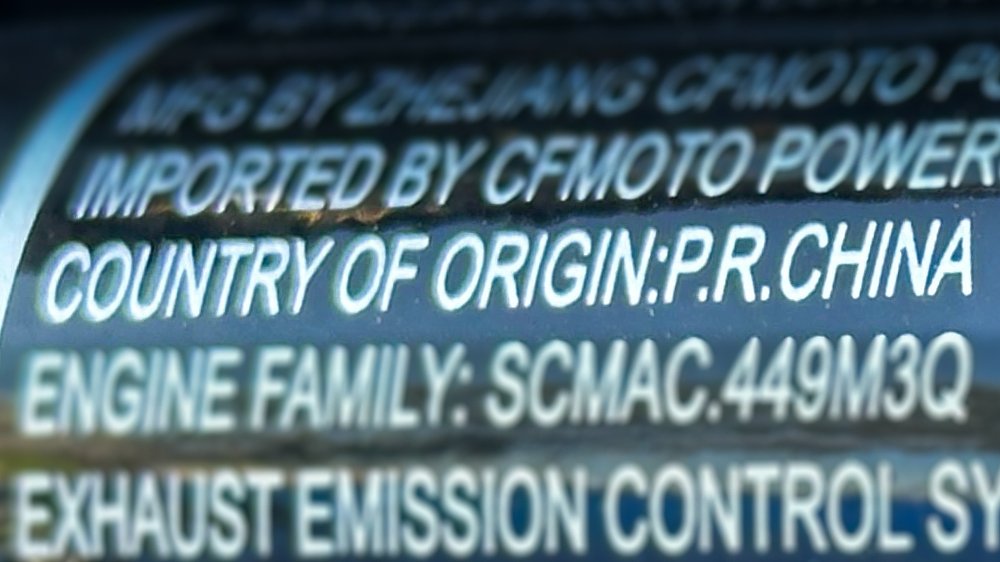

Under the directive, foreign-produced steel and aluminum contained within each motorbike imported into the United States is now subject to a 50% tax. The previously imposed country-based "reciprocal tariffs" still apply to the bike’s non-steel/aluminum components, but it’s unclear whether the metals incur dual duties or not. That's not the only detail driving confusion around the tariffs.

The updated product list, posted to the Federal Register on Tuesday, doesn’t mention motorcycles by name. Instead, it includes several Harmonized Tariff Schedule of the United States (HTSUS) codes for motorcycles, all of which start with 8711. Not all codes and categories are included, however. While motorcycles between 250 cc and 500 cc (8711.30), those exceeding 800 cc (8711.50), and electric-driven models (8711.60) make the list, bikes under 50 cc (8711.10), between 50 cc and 250 cc (8711.20), and between 500 cc and 800 cc (8711.40) are missing. Entries within those segments are just as likely to contain steel and aluminum, so there's no obvious explanation for the omission of those codes.

Another facet of the tariffs that concern freight shipper and manufacturers is its expedited implementation. Announced by the Customs and Border Protection agency on Friday evening (7:26 p.m. EDT, to be exact), the new trade policy went into effect on Monday, meaning all goods currently in transit now fall under the broadened guidelines.

Past is prologue

In 2018, the first Trump administration established a 25% tariff on steel imports and a 10% tariff on aluminum imports. Those tariffs later expanded to include specific derivative products in 2020. Those rates were maintained during Joe Biden’s presidency, but U.S. allies like Canada, Mexico, Japan, and South Korea received exemptions.

In March of this year, Trump not only cancelled those exemptions but also raised aluminum duties to 25%. By June, the tariff rates surged to 50%. Friday’s announcement is just the latest escalation, which seeks to eliminate what the administration calls “duty evasion schemes.”

“Today’s action expands the reach of the steel and aluminum tariffs and shuts down avenues for circumvention,” said U.S. Secretary of Commerce for Industry and Security Jeffrey Kessler, “supporting the continued revitalization of the American steel and aluminum industries.”

The goal of Trump’s policies is to boost U.S. companies and support opportunities for workers, but an International Trade Commission study conducted in 2023 found that the 2018 metals duties only marginally improved steel and aluminum production in the States; all while increasing the costs of automobiles, machines, and tools in the process.

Barriers to entry

The tariff expansion arrives as shipments to the United States continue to slow. Japan, for instance, reduced its exports to the country by 11.4% in June and 10.1% in July (the government data doesn’t specify whether Honda, Kawasaki, Suzuki, or Yamaha are included). The addition of derivative product duties don’t bode well for trade, either, according to the Motorcycle Industry Council (MIC), which opposed the tariffs on derivative products. The MIC expressed concern that some companies in the motorcycle industry would take a financial hit and that some products could no longer be available in the U.S. market.

"Despite our opposition to these new tariffs and our request to be excluded from them, the Department of Commerce decided to move forward with tariffs that broaden the range of products now covered under Section 232," said MIC Senior Vice President of Government Relations Scott Schloegel. "As a nearly $51 billion industry, we will continue to engage with the administration and policymakers to push for balanced trade rules that don’t cripple our industry."