In April, President Trump introduced a range of reciprocal tariffs on U.S. trade partners. What followed was a series of rate escalations, postponements, and negotiations with individual trading partners. All of which led to shifting policies and widespread confusion in the market. Companies began studying ways to handle the increased cost.

For you as the consumer, however, political narratives about tariffs or details of which participant in the supply chain is absorbing which percentage of the added cost are not what matters. The main detail that matters to the consumer is the number on the price tag of the new motorcycle or gear you want to buy. With motorcycle manufacturers and retailers rolling out the first wave of import surcharges on new motorcycles and gear, we're starting to see those numbers.

On select models and trims

Earlier this year, KTM unveiled its new 390 SMC R, 390 Enduro R, and 390 Adventure range. Although the models arrived with impressive specs and advanced rider aids, it was their budget-friendly price tags that generated the most buzz. Ranging from $5,499 to $6,999, the 390s looked poised to upend the small-capacity category. Those prices were announced before the main round of tariffs, however.

KTM’s website currently lists an “Import Duty Surcharge” on all 2025 390 models, including the long-running 390 Duke. The additional fee amounts to about 10% of the bike’s MSRP. Take the 390 Adventure R, for example, which retails for $6,999 and now comes with a $700 import duty surcharge.

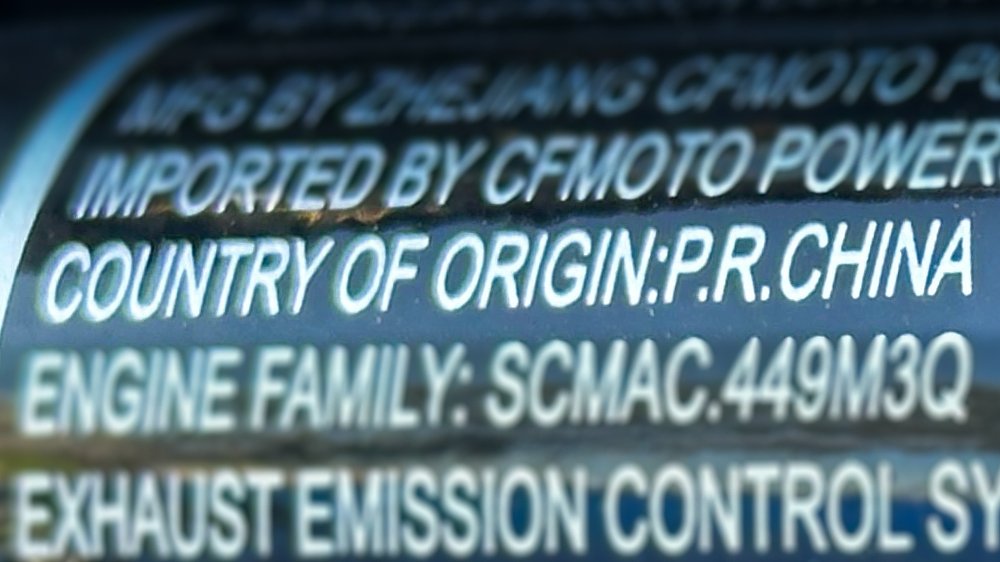

Of course, KTM manufactures its 390 range in India. President Trump initially proposed a 26% tax on goods imported from India before pausing the tariffs for 90 days. That period will end on July 9, but products shipped from India, including KTM 390 deliveries, are subject to a 10% baseline tax in the interim. So it makes sense to see a 10% surcharge. Of course KTM isn’t the only manufacturer grappling with tariffs.

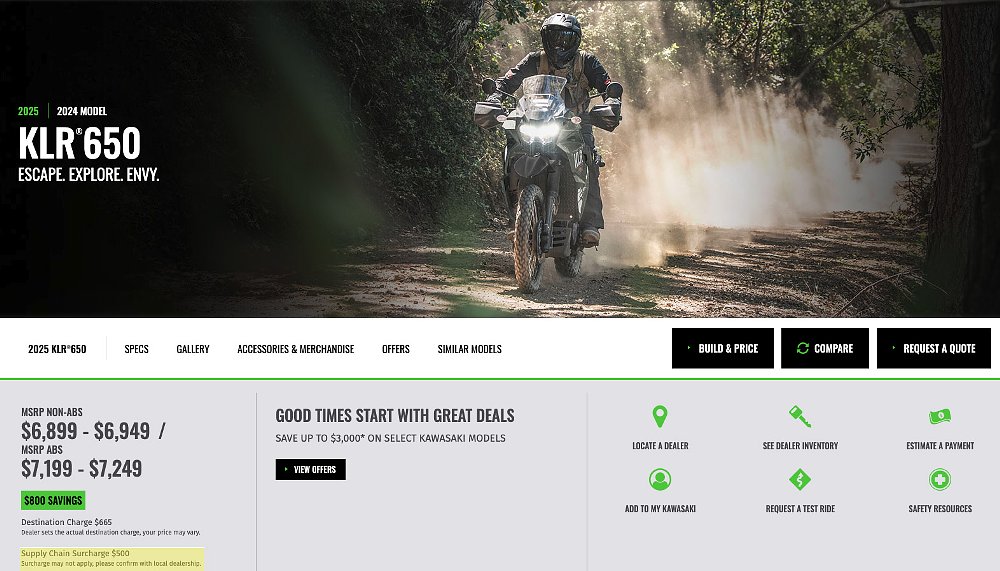

In early June, Kawasaki added a “Supply Chain Surcharge” to every model in its 2025 lineup. It didn’t last long, though. On Tuesday, Kawi removed the line item from all model webpages. Now, the brand only reports an import surcharge on its returning KLX models and recently announced 2026 KLX230 Sherpa S and KLX230 DF. That doesn’t mean all 2025 Kawasakis are exempt from the supply chain fee, however.

Reps for KTM and Kawasaki both stressed that the vehicle’s model year, country of origin, and order date will determine whether tariff-related fees apply. If the manufacturer didn’t pay additional taxes to import the bike, neither will the customer. For that reason, tariff surcharges will apply on a case-by-case basis.

When asked whether tariff fees will still apply to 2025 models, Kawasaki Media Relations Supervisor Brad Puetz explained that the “website is a first resource but the customer will need to see the actual unit on the floor at their dealership to know if the surcharge applies on that VIN.”

That aligns with my recent experience at a local dealership, Del Amo Motorsports of Redondo Beach, California. While all the bikes on the showroom floor (including a 390 SMC R and 390 Adventure R) were imported before the tariffs, a salesperson stated that the “next batch” of Kawasakis and Ducatis would include an import fee. However, Ducati North America CEO Jason Chinnock refuted the claim, saying “There are no tariff surcharges planned from Ducati.” Talk about confusing.

For you, the consumer, the bottom line is this: The situation continues to evolve and you may walk into your local dealership and find certain individual motorcycles with surcharges related to tariffs and others that were imported earlier and don't carry a surcharge. It's a much different story when it comes to gear.

Behind the curtain

While some motorcycle manufacturers are listing the additional tariff-related fees separately from the MSRP, most retailers are lumping those costs into a product’s listed price. That includes Common Tread sister brands RevZilla, Cycle Gear, and J&P Cycles. At the time of writing, the three Comoto retailers have already implemented price increases on about 30% of product inventory.

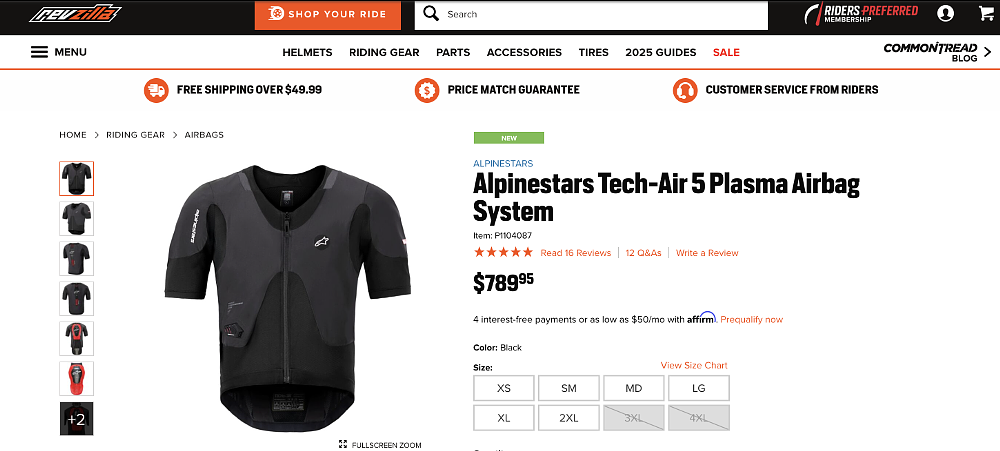

Cycle Gear Vice President of Merchandising Bill Beers acknowledged that price tags have gone up by “3% to 5%” on products that saw increases. A prime example is the Alpinestars Tech-Air 5 Plasma, which debuted at $789.95 (see below) and rose to $829.95 in May. A $40 price hike isn't an insignificant difference, but retailers, like OEMs, are doing their best to minimize the costs passed on to the consumer.

Beers explained that Comoto and its suppliers are both “eating a little bit” of the tariff-associated costs, which softens the impact on the customer’s wallet. Still, Beers admitted that brands like “HJC, Shoei, and Arai have not done price increases yet” and that he expects most rate adjustments to occur “in June.”

The tariff situation only continues to evolve as manufacturers and retailers roll out the first wave of price increases. On the other hand, a well informed customer is a prepared customer. Whether tariff surcharges show up as an additional line item or get folded into the retail price, more markups are in store. Yes, tariffs are still confusing, but knowing what to look for helps brings some clarity to the situation.