The second quarter of each year is, traditionally, the best quarter for U.S. motorcycle sales. It is spring. Motorcyclists’ thoughts turn to warm weather, the open road and, perhaps, a new motorcycle. This is what makes Harley-Davidson’s poor Q2 earnings results particularly troubling.

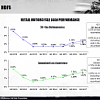

Harley-Davidson reported that sales fell 7.7 percent in the second quarter of 2017 versus the same period last year. The company now expects 2017 shipments to decline between 6 percent and 8 percent versus 2016. Previously, H-D management had stated that it expected 2017 shipments to be “flat to down modestly.”

Global sales fell 6.7 percent and U.S. sales fell a troubling 9.3 percent. Not only are Harley-Davidson’s sales slipping, but its market share is eroding, too, which means at least some of the trouble is specific to Harley-Davidson, not the overall industry. Harley’s share of the U.S. heavyweight (over 600 cc) street motorcycle market declined to 48.5 percent from 51.3 percent.

H-D also reported a rise in loan delinquencies. This is something to which we need to pay attention because, if motorcycle loan delinquencies increase, we could see credit become constrained across the industry. Elsewhere, Bloomberg News reported yesterday on a similar situation occurring in the automobile lending space.

Harley-Davidson management seems to understand what is happening and what needs to be done. However, it does not appear to have a good handle on how to do it. Management stressed the importance of rider’s schools that feature its XG Street series motorcycles. That is a good start, but based on what numerous young riders have told me, the styling and capabilities of the XG series are not quite what they desire. In my opinion, the styling of the XG has an air of reluctance about it. It is almost as if H-D stylists said, “Alright. We’ll design a standard, if we have to.”

Does Wall Street understand Harley-Davidson?

While management may understand the issues, the Wall Street analyst community seems to be just a bit out of touch with what vexes The Motor Company. A few weeks back, Bernstein analyst David Beckel opined that Harley-Davidson is suffering from “secular erosion.” In other words, its customer base is aging. This may explain much, if not most, of the overall drop in sales, but it does not address the fact that many young people who do ride would not consider purchasing a Harley-Davidson.

Following today’s earnings report, UBS analyst Robin Farley expressed concern that not even a new engine (the Milwaukee-Eight) had improved sales. She appears to miss the point that it is not Harley’s engines which will make or break sales or affect market share, but rather the product line’s success in resonating with young riders to replace its aging core customers.

Morgan Stanley analysts Adam Jones asked, after the earnings results: "Who’s buying bikes these days?" This was not a rhetorical question, but one for which he does not have a good answer. In spite of the sales and market share trends, Jones maintains an “overweight” rating on HOG stock, based on current valuations.

My concern is that, unless HOG does something different, something more differentiated from traditional H-D models than the XG series, the company will be doing the same thing over and over and expecting different results (although not to the same degree as Indian). This is how Einstein defined insanity.

The truth is, very few Wall Street analysts covering the powersports industry ride or have ever ridden motorcycles. For most of them, a Harley-Davidson is a motorcycle. It often escapes them that not every motorcyclist desires to own a Harley. As such, analysts often downplay the possibility that H-D could be losing customers to competition. They concentrate instead on the demographics story.

Attention now shifts to Polaris, which is scheduled to report second-quarter earnings Thursday. Polaris has been experiencing similar challenges as Harley-Davidson with its motorcycle business. In January, Polaris shuttered its nearly two-decade-old Victory Motorcycles unit to focus on its Indian brand. I expect Polaris to report similar challenges as H-D from its motorcycle business.

Harley-Davidson's road ahead

What do I see ahead for Harley-Davidson? I see more of the same. Unless the company has something new and exciting in the works, why should anyone expect different results? Adding to my concerns is that it appears that we are in the latter stages of a credit cycle. Job growth is slowing and, thanks to automation, a lack of bargaining power among workers and a lack of pricing power among companies augurs for slow wage growth. We have seen this reflected in soft wage growth and weak retail sales data. Harley-Davidson is not going to help the employment data as it announced more job cuts yesterday.

How should Harley-Davidson contend with unfavorable demographics, the tastes of younger riders and a potential winding down of the current economic expansion?

Rather than seeking to buy Ducati, if I were H-D management, I would trim cruiser offerings to free-up resources to develop a better standard platform or to refine, expand and restyle the XG. I would also reverse Harley's course of forcing dealers to sell Harley-Davidsons in stand-alone dealerships and seek to sign up dealers who offer foreign brands, with models focused on the youth market. That way, consumers who might not think about going into a Harley-Davidson dealership would be exposed to the company's offerings.

If the proverbial mountain won’t come to the MoCo, then the MoCo will have to come to the mountain.